Page 177 - CW E-Magazine (9-1-2024)

P. 177

Special Report Special Report

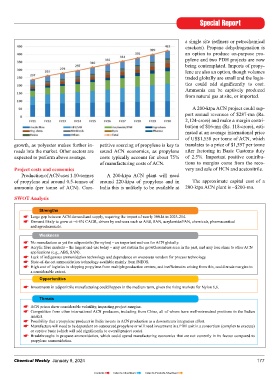

Table 2: Imports of ACN only about 3% of overall ACN demand, a single site (refi ners or petrochemical

Quantity, kt CIF Value, $ mn Average CIF price, $/t in 2020-21 its share has risen to 17%. crackers). Propane dehydrogenation is

2016-17 195 $232 $1,215 Overall, ACN demand has seen an an option to produce on-purpose pro-

pylene and two PDH projects are now

2017-18 266 $414 $1,591 average growth of 6.2% per year in the being contemplated. Imports of propy-

2018-19 293 $555 $1,933 period from 2016-17 to 2020-21. lene are also an option, though volumes

2019-20 294 $469 $1,624 traded globally are small and the logis-

ACN demand for acrylic fi bre now

2020-21 268 $298 $1,259 represents about one-third of the over- tics could add signifi cantly to cost.

Ammonia can be captively produced

2021-22 292 $616 $2,130 all market, down from nearly half of the from natural gas at site, or imported.

2022-23 410 $638 $1,556 overall market in 2016-17, consequent

2023-24 210 $256 $1,219 to the lesser than average growth in A 200-ktpa ACN project could sup-

[April-Oct] demand as compared to other applica- port annual revenues of $287-mn (Rs.

tions. ABS/SAN demand accounted 2,124-crore) and make a margin contri-

70-100 kt, when the RIL plant was ope- by the three major end-uses: acrylic for 23% of overall demand in 2020-21, bution of $16-mn (Rs. 118-crore), esti-

rating, have risen since its closure, and fi bre, ABS/SAN resins and acrylamide/ while demand for acrylamide/PAN took mated at an average international price

reached a high of 410-kt in 2022-23. PAN. Signifi cant quantities are also a 16% share. Consumption for making of US$1,558 per tonne of ACN, which

consumed by the agrochemical and several agrochemicals represented an growth, as polyester makes further in- petitive sourcing of propylene is key to translates to a price of $1,597 per tonne

The USA has been the single largest organic chemical industries. Demand for additional 6% of total demand. roads into the market. Other sectors are sound ACN economics, as propylene after factoring in Basic Customs duty

supplier of ACN in the Indian market, making NBR and nitrile latex has been expected to perform above average. costs typically account for about 75% of 2.5%. Important positive contribu-

accounting for 30% of total imports impacted by cheap imports from China. In the period from FY22 to FY25, of manufacturing costs of ACN. tions to margins come from the reco-

by India. Japan (18%), China (16%), demand is expected to grow at a CAGR Project costs and economics very and sale of HCN and acetonitrile.

Singapore (15%), Taiwan (9%) and UAE In 2020-21, demand remained of 6.4% – near abouts the historical Production of ACN uses 1.10-tonnes A 200-ktpa ACN plant will need

(5%) were other suppliers into India. almost fl at over the previous year at pace of growth. By 2024-25, ACN of propylene and around 0.5-tonnes of around 220-ktpa of propylene and in The approximate capital cost of a

Together, these six countries accounted 237-kt. The decline in demand for demand is forecast to reach 316-kt. ammonia (per tonne of ACN). Com- India this is unlikely to be available at 200-ktpa ACN plant is ~$200-mn.

for about 92% of total imports in 2022-23. acrylic fi bre and ABS/San resin was

compensated by a rise in consumption In the ensuing fi ve year period to SWOT Analysis

In the fi rst seven months of 2023-24 for acrylamide/PAN. Demand in 2023- 2029-30, ACN demand is expected

(April-October), imports of ACN were 24 is estimated to be about 300-kt. to moderate to a growth rate of 6.0%, Strengths

about 210-kt. reaching 423-kt in 2029-30. Large gap between ACN demand and supply, requiring the import of nearly 300-kt in 2023-214.

The share of acrylamide/PAN in over- Demand likely to grow at ~6-8% CAGR, driven by end-uses such as ABS, SAN, acrylamide/PAN, chemicals, pharmaceutical

and agrochemicals.

The Basic Customs Duty (BCD) on all demand for ACN has increased: while Demand for acrylic fi bre is expected

ACN imports has remained unchanged in 2016-17 this segment accounted for to underperform the overall market Weakness

at 2.5% since 2016-17. No manufacture as yet for adiponitrile (for nylon) – an important end-use for ACN globally.

2020-21 Acrylic fi bre markets – the largest end-use today – may not sustain the growth numbers seen in the past, and may lose share to other ACN

applications (e.g., ABS, SAN).

Demand Resins 0.3% Lack of indigenous ammoxidation technology and dependence on oveseseas vendors for process technology.

Demand for ACN is largely driven Pharma 1.0% State-of-the-art ammoxidation technology available mainly from INEOS.

Table 3: Import of ACN by country Others 14.0% High cost of logistics in shipping propylene from multiple production centres, and ineffi ciencies arising from this, could erode margins to

of origin Dyes 1.9% a considerable extent.

Country Quantity, Kt Share Acrylic fi bre 31.6% Opportunities

USA 121 30% NBR 3.3% Investments in adiponitrile manufacturing could happen in the medium term, given the rising markets for Nylon 6,6.

Japan 76 18% Org Chem 4.2% Threats

China 64 16% ACN prices show considerable volatility, impacting project margins.

Singapore 62 15% Acrylamide & Competition from other international ACN producers, including from China, all of whom have well-entrenched positions in the Indian

PAN 16.4%

market.

Taiwan 36 9% Agro 4.5% ABS/SAN 22.7% Possibility that a propylene producer in India invests in ACN production as a downstream integration effort.

UAE 20 5% Manufacture will need to be dependent on outsourced propylene or will need investment in a PDH unit in a consortium (complex to execute)

or captive basis (which will add signifi cantly to overall project costs).

South Korea 17 4% Breakthroughs in propane ammoxidation, which could upend manufacturing economics that are not currently in its favour compared to

Total 410 100% propylene ammoxidation.

176 Chemical Weekly January 9, 2024 Chemical Weekly January 9, 2024 177

Contents Index to Advertisers Index to Products Advertised