Page 164 - CW E-Magazine (9-1-2024)

P. 164

News from Abroad

MARKET REPORT

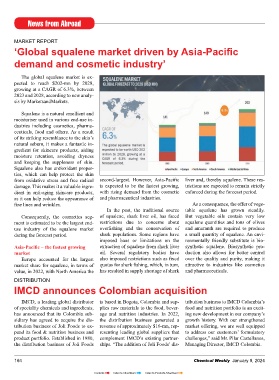

‘Global squalene market driven by Asia-Pacific

demand and cosmetic industry’

The global squalene market is ex-

pected to reach $202-mn by 2028,

growing at a CAGR of 6.3%, between

2023 and 2028, according to new analy-

sis by MarketsandMarkets.

Squalene is a natural emollient and

moisturiser used in various end-use in-

dustries including cosmetics, pharma-

ceuticals, food and others. As a result

of its striking resemblance to the skin’s

natural sebum, it makes a fantastic in-

gredient for skincare products, aiding

moisture retention, avoiding dryness

and keeping the suppleness of skin.

Squalene also has antioxidant proper-

ties, which can help protect the skin

from oxidative stress and free radical second-largest. However, Asia-Pacific liver and, thereby squalene. These res-

damage. This makes it a valuable ingre- is expected to be the fastest growing, trictions are expected to remain strictly

dient in anti-aging skincare products, with rising demand from the cosmetic enforced during the forecast period.

as it can help reduce the appearance of and pharmaceutical industries.

fine lines and wrinkles. As a consequence, the offer of vege-

In the past, the traditional source table squalene has grown steadily.

Consequently, the cosmetics seg- of squalene, shark liver oil, has faced But vegetable oils contain very low

ment is estimated to be the largest end- restrictions due to concerns about squalene quantities and tons of olives

use industry of the squalene market overfishing and the conservation of and amaranth are required to produce

during the forecast period. shark populations. Some regions have a small quantity of squalene. An envi-

imposed bans or limitations on the ronmentally friendly substitute is bio-

Asia-Pacific – the fastest growing extraction of squalene from shark liver synthetic squalene. Biosynthetic pro-

market oil. Several regulatory bodies have duction also allows for better control

Europe accounted for the largest also imposed restrictions such as fixed over the quality and purity, making it

market share for squalene, in terms of quotas for shark fishing, which, in turn, attractive to industries like cosmetics

value, in 2022, with North America the has resulted in supply shortage of shark and pharmaceuticals.

DISTRIBUTION

IMCD announces Colombian acquisition

IMCD, a leading global distributor is based in Bogota, Colombia and sup- tribution business to IMCD Colombia’s

of speciality chemicals and ingredients, plies raw materials to the food, bever- food and nutrition portfolio is an excit-

has announced that its Colombia sub- age and nutrition industries. In 2022, ing new development in our company’s

sidiary has agreed to acquire the dis- the distribution business generated a growth history. With our strengthened

tribution business of Joli Foods to ex- revenue of approximately $16-mn, rep- market offering, we are well equipped

pand its food & nutrition business and resenting leading global suppliers that to address our customers’ formulatory

product portfolio. Established in 1980, complement IMCD’s existing partner- challenges,” said Mr. Pilar Castellanos,

the distribution business of Joli Foods ships. “The addition of Joli Foods’ dis- Managing Director, IMCD Colombia.

164 Chemical Weekly January 9, 2024

Contents Index to Advertisers Index to Products Advertised