Page 124 - CW E-Magazine (19-8-2025)

P. 124

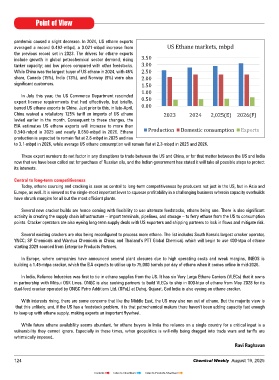

demand related to the pandemic caused a slight decrease. In 2024, US ethane exports averaged a record 0.492-

mbpd, a 0.021-mbpd increase from the previous record set in 2023. The drivers for ethane exports include

growth in global petrochemical sector demand; rising tanker capacity; and low prices compared with other

feedstocks.While China was the largest buyer of US ethane in 2024, with 46% share, Canada (15%), India

(13%), and Norway (9%) were also significant customers.

In July this year, the US Commerce Department rescinded export license requirements that had effectively, but

briefly,briefly barred US ethane exports to China. Just prior to this, in late-April, China waived a retaliatory

125% tariff on imports of US ethane levied earlier in the month. Consequent to these changes, the EIA estimates

US ethane exports will increase to more than 0.540-mbpd in 2025 and nearly 0.650-mbpd in 2026. Ethane

production is expected to remain flat at 2.8-mbpd in 2025 and rise to 3.1-mbpd in 2026, while average US

ethane consumption will remain flat at 2.3-mbpd in 2025 and 2026.

Ethane exports from the US have increased almost every year since 2014, except in 2020, when muted global

These export numbers do not factor in any disruptions to trade between the US and China, or for that matter

Point of View between the US and India now that we have been called out for purchase of Russian oils, and the Indian

government has stated it will take all possible steps to protect its interests.

pandemic caused a slight decrease. In 2024, US ethane exports

averaged a record 0.492-mbpd, a 0.021-mbpd increase from US Ethane markets, mbpd

the previous record set in 2023. The drivers for ethane exports

include growth in global petrochemical sector demand; rising 3.50

tanker capacity; and low prices compared with other feedstocks. 3.00

While China was the largest buyer of US ethane in 2024, with 46% 2.50

share, Canada (15%), India (13%), and Norway (9%) were also 2.00

significant customers. 1.50

In July this year, the US Commerce Department rescinded 1.00

export license requirements that had effectively, but briefly, 0.50

barred US ethane exports to China. Just prior to this, in late-April, 0.00

China waived a retaliatory 125% tariff on imports of US ethane 2023 2024 2,025(E) 2026(F)

levied earlier in the month. Consequent to these changes, the

EIA estimates US ethane exports will increase to more than

0.540-mbpd in 2025 and nearly 0.650-mbpd in 2026. Ethane Production Domestic consumption Exports

production is expected to remain flat at 2.8-mbpd in 2025 and rise

to 3.1-mbpd in 2026, while average US ethane consumption will remain flat at 2.3-mbpd in 2025 and 2026.

Central to long-term competitiveness

Today, ethane sourcing and cracking is seen as central to long-term competitiveness by producers not just in the

These export numbers do not factor in any disruptions to trade between the US and China, or for that matter between the US and India

now that we have been called out for purchase of Russian oils, and the Indian government has stated it will take all possible steps to protect

US, but in Asia and Europe, as well. It is viewed as the single-most important lever to squeeze profitability in a

its interests.

challenging business wherein capacity overbuilds have shrunk margins for all but the most efficient plants.

Central to long-term competitiveness

Several new cracker builds are hence coming with flexibility to use alternate feedstocks, ethane being one.

Today, ethane sourcing and cracking is seen as central to long-term competitiveness by producers not just in the US, but in Asia and

There is also significant activity in creating the supply chain infrastructure – import terminals, pipelines, and

Europe, as well. It is viewed as the single-most important lever to squeeze profitability in a challenging business wherein capacity overbuilds

have shrunk margins for all but the most efficient plants. storage –to ferry ethane from the US to consumption points. Cracker operators are also eyeing long-term supply

deals with US exporters and shipping partners to lock in flows and mitigate risk.

Several new cracker builds are hence coming with flexibility to use alternate feedstocks, ethane being one. There is also significant

activity in creating the supply chain infrastructure – import terminals, pipelines, and storage – to ferry ethane from the US to consumption

Several existing crackers are also being reconfigured to process more ethane. The list includesSouth Korea’s

points. Cracker operators are also eyeing long-term supply deals with US exporters and shipping partners to lock in flows and mitigate risk.

largest cracker operator, YNCC;SP Chemicals and Wanhua Chemicals in China;andThailand’s PTT Global

Chemical, which will begin to use 400-ktpa of ethane starting 2029 sourced from Enterprise Products Partners.

Several existing crackers are also being reconfigured to process more ethane. The list includes South Korea’s largest cracker operator,

YNCC; SP Chemicals and Wanhua Chemicals in China; and Thailand’s PTT Global Chemical, which will begin to use 400-ktpa of ethane

starting 2029 sourced from Enterprise Products Partners.

In Europe, where companies have announced several plant closures due to high operating costs and weak

margins, INEOS is building a 1.45-mtpa cracker, which the EIA expects to utilise up to 75,000 barrels per day

In Europe, where companies have announced several plant closures due to high operating costs and weak margins, INEOS is

of ethane when it comes online in mid-2026.

building a 1.45-mtpa cracker, which the EIA expects to utilise up to 75,000 barrels per day of ethane when it comes online in mid-2026.

In India, Reliance Industries was first to tie in ethane supplies from the US. It has six Very Large Ethane Carriers (VLECs) that it owns

In India, Reliance Industries was first to tie in ethane supplies from the US. It has six Very Large Ethane

in partnership with Mitsui OSK Lines. ONGC is also seeking partners to build VLECs to ship in 800-ktpa of ethane from May 2028 for its

Carriers (VLECs) that it owns in partnership with Mitsui OSK Lines. ONGC is also seeking partners to build

dual-feed cracker operated by ONGC Petro Additions Ltd. (OPaL) at Dahej, Gujarat. Gail India is also eyeing an ethane cracker.

VLECsto ship in 800-ktpa of ethane from May 2028 for itsdual-feed cracker operated by ONGC Petro

Additions Ltd. (OPaL) at Dahej, Gujarat.Gail India is also eyeing an ethane cracker.

With interests rising, there are some concerns that like the Middle East, the US may also run out of ethane. But the majority view is

that this unlikely, and, if the US has a feedstock problem, it is that petrochemical makers there haven’t been adding capacity fast enough

With interests rising, there are some concerns that like the Middle East, the US may also run out of ethane. But

to keep up with ethane supply, making exports an important flywheel.

the majority viewis that this unlikely, and, if the US has a feedstock problem, it is that petrochemical makers

While future ethane availability seems abundant, for ethane buyers in India the reliance on a single country for a critical input is a

vulnerability they cannot ignore. Especially in these times, when geopolitics is will-nilly being dragged into trade wars and tariffs are CHEMICAL WEEKLY

98 FEBRUARY 4, 2003

whimsically imposed.

Ravi Raghavan

124 Chemical Weekly August 19, 2025

Contents Index to Advertisers Index to Products Advertised