Page 174 - CW E-Magazine (29-4-2025)

P. 174

Methanol – India’s missed opportunities and recommended strategies

N.S.Venkataraman

Director, Nandini consultancy Centre

Chennai

Email: nandinichemical@gmail.com

Methanol is an important building block, extensively used as feedstock in multiple application sectors. In recent

times,the use of methanol asfuel has been increasingly highlightedall over the world.

Unfortunately, India has not been able to exploitthe investment opportunities basedon methanol to any reasonable level

due to several constraints.

Production and import dependence

There arefive units in Indiawith capabilityfor the production of methanol and three of them are not operatingatpresent.

The overall capacity utilisation of the methanol industry in Indiais just around 31%, considering the installed capacity

of all five methanol units.

India presently imports around3.1-mt of methanol annually and importsare steadily increasing at around7% per

annum.Most of these imports are from natural gas rich countries in the Middle East.

3,500

3,066

2,816

3,000

2,500

2,000

1,500

1,000

500 2,220 2,398 Special Article 2 (22.04.2025)

0

Special Report FY23 FY24

FY22

FY21

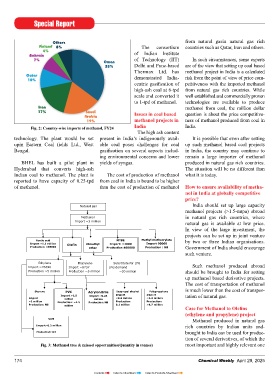

Fig. 1: India imports of methanol, kilotonnes

Others from natural gasin natural gas rich

Finland 8% The consortium countries such as Qatar, Iran and others.

4% of Indian Institute

Bahrain

7% of Technology (IIT) In such circumstances, some experts

Oman

35% Delhi and Pune-based are of the view that setting up coal based

Thermax Ltd. has methanol project in India is a calculated

Qatar demonstrated India- risk from the point of view of price com-

10%

centric gasifi cation of petitiveness with the imported methanol

high-ash coal at 6-tpd from natural gas rich countries. While

scale and converted it well established and commercially proven

to 1-tpd of methanol. technologies are available to produce

Iran methanol from coal, the million dollar

17% Saudi Issues in coal based question is about the price competitive-

Arabia

19% methanol projects in ness of methanol produced from coal in

Fig. 2: Country-wise imports of methanol, FY24 India India.

The high ash content

Why low capacity utilisationand large import dependence?

technology. The plant would be set present in India’s indigenously avail- It is possible that even after setting

The capacity utilisation of Indian methanol industry is low, as Indian units are unable to compete with the imported

upin Eastern Coal fi elds Ltd., West able coal poses challenges for coal up such methanol based coal projects

methanol in price terms.

Bengal. gasifi cation on several aspects includ- in India, the country may continue to

ing environmental concerns and lower remain a large importer of methanol

1

BHEL has built a pilot plant in yields of syngas. produced in natural gas rich countries.

Hyderabad that converts high-ash The situation will be no different than

Indian coal to methanol. The plant is The cost of production of methanol what it is today.

reported to have capacity of 0.25-tpd from coal in India is bound to be higher

of methanol. than the cost of production of methanol How to ensure availability of metha-

Special Article 2 (22.04.2025) nol in India at globally competitive

price?

Natural gas India should set up large capacity

methanol projects (>1.5-mtpa) abroad

Methanol in natural gas rich countries, where

Import ~3 million

natural gas is available at low price.

In view of the large investment, the

projects can be set up in joint venture

Acetic acid MTBE Methyl methacrylate by two or three Indian organisations.

Import ~1.1 million Olefin Dimethyl Import: ~1000 Import 90000

Production: 165000 ether Production 460000 Production : Nil Government of India should encourage

such venture.

Ethylene Propylene Substitute for LPG

Import ~76690 Import ~8737 LPG demand Such methanol produced abroad

Production ~5 million Production ~5 million ~30 million should be brought to India for setting

up methanol based derivative projects.

The cost of transportation of methanol

Styrene PVC Acrylonitrile Isopropyl alcohol Polypropylene is much lower than the cost of transpor-

Import ~2.5 Import ~0.25 Import Import tation of natural gas.

Import million million ~0.2 million ~1.3 million

~1 million Production: ~1.5 Production: Nil Production: Production:

Production: Nil million 0.1 million ~4.7 million

Case for Methanol to Olefi ns

(ethylene and propylene) project

VAM Methanol produced in natural gas

Import~0.2 million rich countries by Indian units and-

Production: Nil brought to India can be used for produc-

tion of several derivatives, of which the

Fig. 3: Methanol tree & missed opportunities(Quantity in tonnes) most important and highly relevant one

Case for Methanol to Olefins(ethylene and propylene )project

Methanol produced in natural gas rich countries by Indian units andbrought to India can be used forproduction of

several derivatives, of which the most important andhighly relevant one for India arethe olefins, ethylene and propylene.

Both are in short supply in India and there is steady increase in demand. Due to short supply, several investment

174 opportunities for downstream products are being lost Chemical Weekly April 29, 2025

Due to hazardous nature of the productsand transportation issues involved, large scale import of propylene and ethylene

is difficult. Therefore, there is compelling need to produce them in India to sustain the industrial and economic growth.

Contents Index to Advertisers Index to Products Advertised

At present, ethylene and propylene are produced from naphtha and natural gas in India.The countryis heavily dependent

on import of crude oil and natural gas, withheavy outflow of foreign exchangeand with fluctuating prices.

By 2029-30, India is expected to need additional capacity of 10.603-mtpa for ethylene and 9.916-mtpa for propylene.

3